For supply chains and their logistics real estate, the only constant is change. This paper is the first of a three-part series that will examine the latest consumer and supply chain trends driving logistics real estate. Specifically, in studying waves of change in supply chains, we identify four trends that are positively impacting logistics real estate, each of which can help clarify strategies to future-proof real estate operations and investments:

- Customers are increasingly evaluating end-to-end total network costs rather than individual procurement operations for transportation, real estate and labor—a best practice that forward-thinking customers are adopting

- Optimizing a supply chain often means securing infill logistics real estate for better service and lower total supply chain costs

- The rise of e-commerce is pulling supply chains closer to consumers

- Logistics real estate near consumers has higher barriers to supply and deeper and more diversified demand

I. Introduction

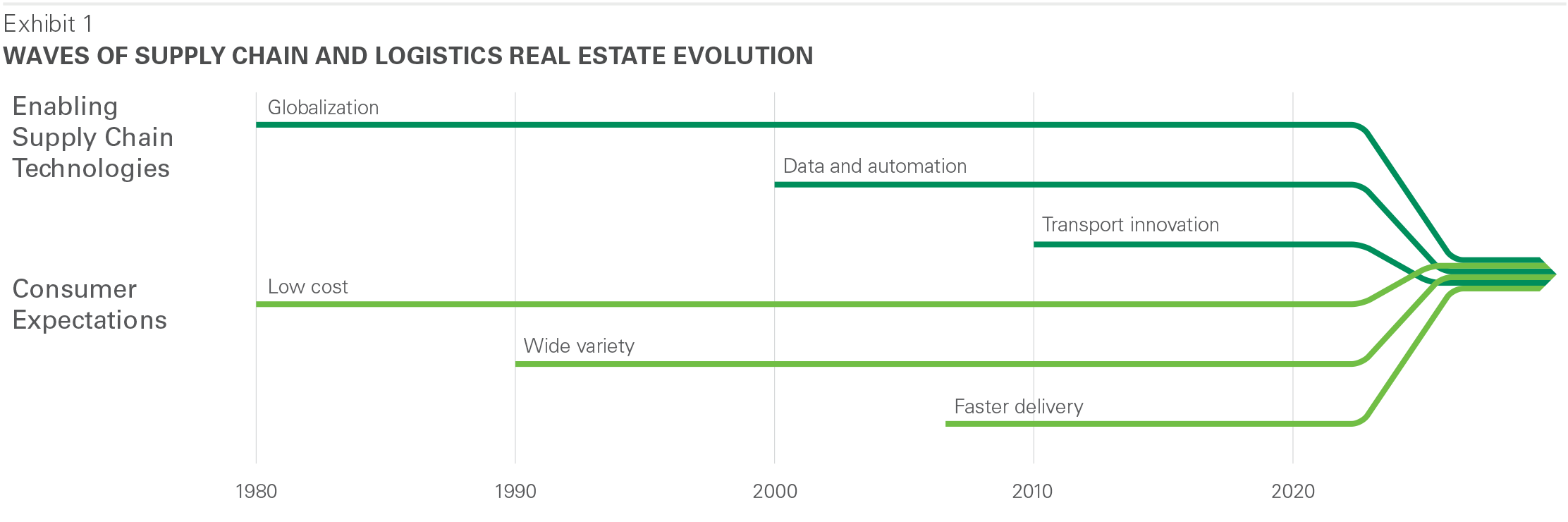

For supply chains, the only constant is change. Strategies evolve as technical capabilities develop and consumer preferences change. These trends create newly sought-after real estate locations and requirements. Durable long-term operational and investment strategies rely on understanding and anticipating this kind of change. To lay a foundation, it is helpful to step back and consider the evolutions in technology and consumer preferences mainly dating back to the early 1980s. These evolutions which have impacted modern logistics real estate include the following:

Enabling supply chain technologies

- Globalization. Beginning in the 1970s and accelerating through the 1980s and 1990s, supply chains became increasingly longer and more global. For real estate, this change prompted building requirements in key transportation nodes. Even today, supply chains continue to globalize and market participants are still catching up with these logistics real estate needs.

- Data & Automation. Industry 4.0 includes the convergence of multiple technologies. The relevant ones currently being implemented for supply chains, including robotics, automation, and big data/predictive analytics, will drive the next evolution in supply chains. In turn, this evolution will drive change for real estate, specifically in the types and locations of logistics real estate that will be most in demand.

- Transportation Innovations. Industry 4.0 also includes several technologies on the horizon that will be relevant to supply chains, namely the energy revolution and rise of alternative fuels, specifically electric and autonomous vehicles. Optimal network strategies will continue to change.

Consumer expectations

- Low Cost. In the 1970s and 1980s, the rise in globalization and international manufacturing led retailers to compete on price.

- Wide Variety. In the 1980s and 1990s, consumers came to expect low-cost, prompting retailers to compete on product variety. These changes put considerable strain on supply chains, necessitating big investments to boost capabilities, including in real estate.

- Faster Delivery. E-commerce has existed for more than two decades. Yet, the impact on supply chains was slow, leading to change only in the last few years. Collectively, e-commerce, while still an emerging trend, is creating new routes to consumers, thus driving demand. In addition, e-commerce has changed consumer service expectations around product variety and delivery times and convenience.

Collectively, these waves create new routes to consumers. In the past, the impact of new technologies and shifting consumer expectations on logistics real estate has been evolutionary. These waves created new requirements, but they did not create a large-scale transformation in terms of location or asset quality. High variety in supply chain and network design, along with elongated rates of adoption of new capabilities, led to a gradual rate of change in the types of real estate most in demand. Additionally, as cities grew, older vintage logistics real estate became infill and increasingly in demand due to its proximity to end-consumers.

With Faster Delivery and Data & Automation, the pace of change for supply chains and logistics real estate is accelerating. To identify and measure the implications for logistics real estate, Prologis Research conducted a deep-dive on recent and emerging supply chain trends. We worked with a leading supply chain and network consultant, The Sequoia Partnership, to catalogue and model the real estate requirements of these emerging supply chain strategies. Our analysis included an examination of costs across multiple distribution models and in many categories, including transportation, labor and real estate. We also measured the value to consumers in terms of convenience and time saved.

Our analysis raised three critical questions regarding the current and near-term environment for logistics real estate:

- What do new network strategies and their emphasis on service quality (raised by e-commerce but now a broad trend) mean for logistics real estate? What are the latest changes for the types and locations of buildings most in demand?

- Are these changes temporary or permanent? What are the economics of these new routes to consumers, and what does this imply about their long-term sustainability?

- What are the implications for logistics real estate demand and pricing due to long-term trends for transportation costs, labor productivity and delivery times?

This paper is the first in the three-part series addressing emerging and prospective supply chain and real estate trends. In this paper we cover the first question by exploring current supply chain trends including an emphasis on changes to location preferences brought about by e-commerce. With the current trends outlined, two subsequent papers will explore future trends covered by our second and third questions above, including (a) the sustainability of these changes and (b) the new changes likely to be ushered in by advances in fields such as big data and robotics.

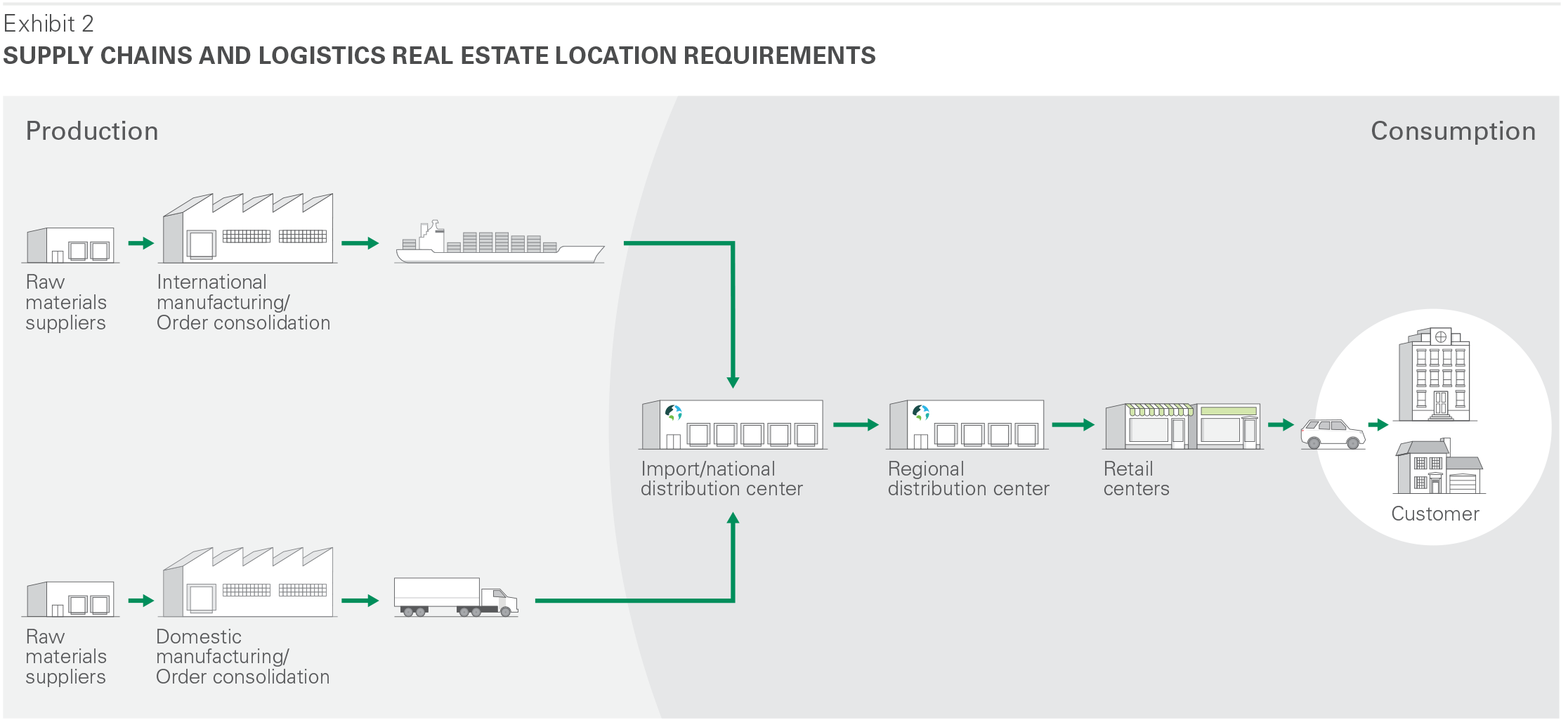

II. Categories of demand & logistics real estate locations

To fully appreciate new supply chain trends and their implications for logistics real estate, specifically new demand ushered in by e-commerce and the service level imperative, it is critical to understand traditional supply chains and their real estate requirements. Upon close review, an end-to-end perspective on supply chains reveals five specific logistics real estate requirement types.

Production-end:

- Suppliers. These requirements bring together and distribute raw materials to manufacturing facilities. Hence, these facilities are located near production facilities.

- Order consolidation. These requirements consolidate outbound exports or domestic shipments of finished goods. These facilities are located between production facilities and transportation nodes, such as ports and other transportation infrastructure.

Consumption-end:

- Import centers and pan-regional distribution. These facilities act as the initial stop for global supply chains within large geographies or as receiving facilities from domestic manufacturing sites (e.g., Southern California, Dallas, and the Netherlands). They often are located near chokepoints of global trade and can either distribute to surrounding populations or act as a deconsolidation point serving other logistics facilities as goods move toward end-consumers.

- Regional distribution. Facilities in these locations are within and adjacent to major population centers and consumption markets. For traditional brick-and-mortar distribution, these facilities are often the last stop for goods before they move to retail storefronts. For e-commerce and direct-to-home distribution, these facilities may place goods into the parcel and Last Touch® network (see below for more details on Last Touch®).

- Retail centers. Traditionally, goods reach consumers at store-front facilities for offline purchases. Retail centers hold limited inventory and consumers must travel to these locations to purchase items.

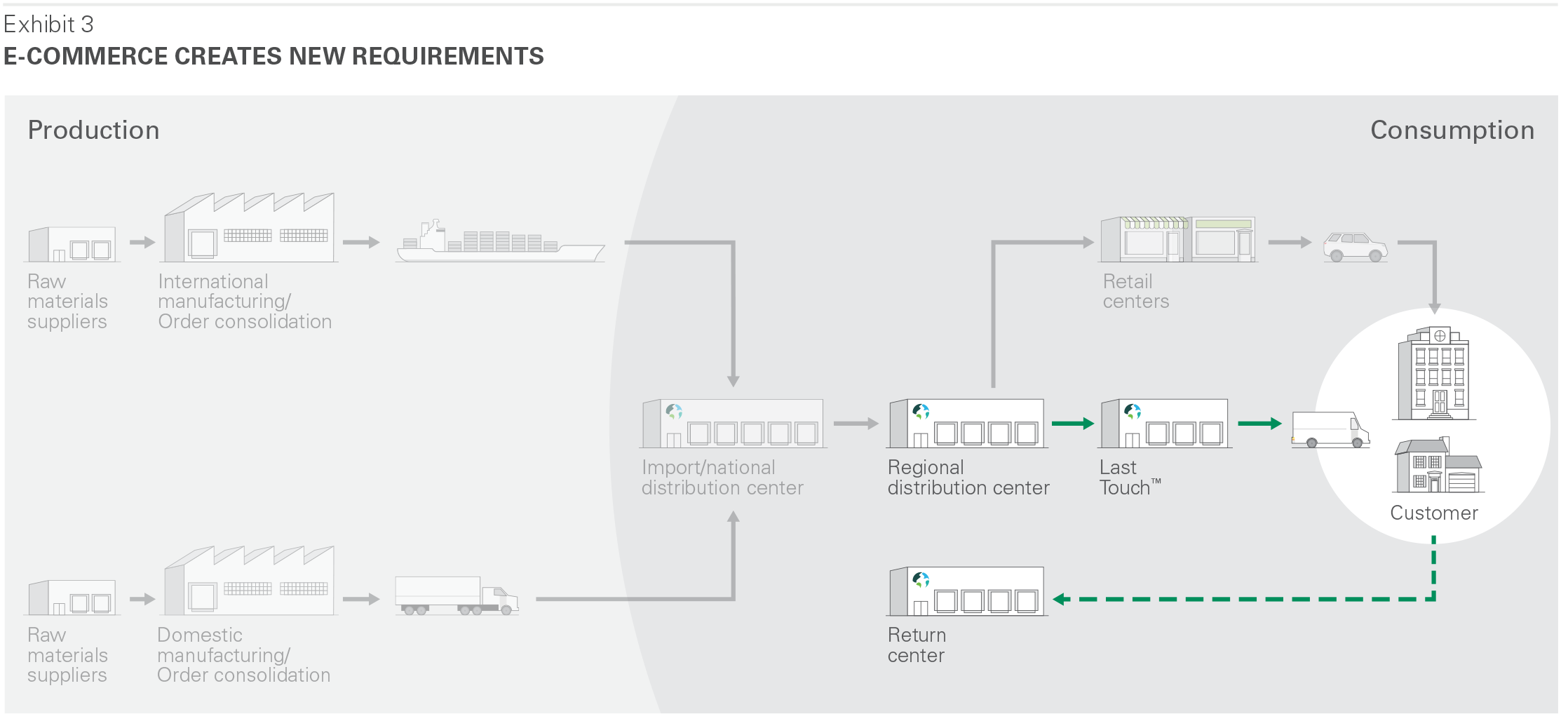

III. E-Commerce adding to demand at the consumption-end of supply chains

E-commerce has been a key force in logistics real estate, but demand has become more concentrated in recent years. Currently, e-commerce accounts for approximately 20% of new leasing, up from less than 5% earlier this decade.1 Moreover, e-commerce continues to enjoy double-digit annual growth. There are many more pure-play online retailers than before. For brick-and-mortar retailers, those with successful online operations (which may now account for an impossible to ignore 25% of revenues, or more) must now strengthen their service delivery capabilities.2 Taken together, capital investment in supply chains has become much more significant in recent years and is poised for continued growth. However, that investment is not uniformly distributed; rather it is concentrated in portions of the supply chain.

E-commerce creates new requirements, which are concentrated at the consumption-end of supply chains. Initial e-commerce requirements, those in the early 2000s, emphasized centralized locations, which pooled inventories and balanced delivery times across a broad geography (but deliveries were slow and expensive). More recently, e-commerce leasing activity has been concentrated at the consumption-end of the supply chain. Specifically, new e-commerce demand has been focused in two areas:

- Regional distribution. The growth of regional distribution centers, as opposed to centralized distribution models, allows online retailers to keep their inventory much closer to end-consumers and meet the short delivery times that consumers expect. In addition, return centers are a growing and important part of the e-commerce ecosystem; their proximity to major consumption centers helps manage the transportation portion of reverse logistics costs and recirculates inventories faster.

- Last Touch®. These are facilities in urban locations and support city distribution. E-commerce has energized demand for this class of facilities, enabling rapid e-fulfilment and time-sensitive distribution. Last Touch® facilities are an extension of established supply chains, not only taking goods to retail centers and storefronts, but also offering higher service levels by facilitating delivery all the way to where consumers live and work. In addition, these locations are ideal for local and small businesses, offering proximity to other customers/suppliers and an ample workforce. The term Last Mile is used but is a bit of a misnomer, as facilities labelled as Last Mile often cover much greater distances. Last Touch® facilities offer two new benefits: advancement of service capabilities (urban sites like these are required for same-day and shorter delivery windows) and management of transportation costs (by allowing the final transportation leg to be split into two).

The emphasis on the consumption-end of supply chains is broadening beyond e-commerce. E-commerce catalyzed higher service level requirements across a spectrum of supply chains. As a result, location strategies even for other industries have evolved, with users moving from simple, centralized distribution models to decentralized systems, shortening their distance to end-consumers. A movement to multiple steps creates flexibility in deconsolidation from containers to pallets, pallets to cartons, and where appropriate, cartons to “eaches.” Such changes increase the responsiveness of supply chains. While multi-site supply chains might sound expensive, in fact logistics real estate is a small share of cost structures. Real estate is approximately 5% of supply chain costs and less than 1% of total costs.3

IV. Changing demand patterns create winners and losers within logistics real estate

Logistics real estate that serves the consumption-end of supply chains offers superior tradeoffs between reward and risk. As measured by long-term rental growth, portfolio occupancy, or diversity and resiliency of customer demand, the performance of logistics real estate varies widely by location strategy. Four factors offer a better long-term value proposition:

- Barriers to supply. Much of the consumption-end of supply chains are characterized by high barriers to supply. Demand is concentrated in infill locations. These major population centers have relatively few new land sites. Hence, occupancies are very high and rents are rising quickly.

- E-Commerce growth. The rise of supply chains to serve e-commerce has just begun, emerging in scale in only the last few years. By contrast, globalization continues to drive demand after several decades and e-commerce topline growth remains double-digit, doubling the industry’s size every five to seven years.4 This growth is concentrated at the consumption-end of supply chains.

- Trade growth. In addition, the rise of globalization continues and creates considerable demand at the chokepoints of global trade. Southern California is the world’s largest logistics real estate market as it acts as the gateway to the U.S. for Asia. A similar trend is at work in many other markets, including markets like Chicago and the port-adjacent markets in Northern Europe, such as Southern Netherlands. Even today, these markets are among the fastest growing as logistics real estate requirements continue to catch up with the globalized nature of supply chains. On the margin, these requirements tend to be import and pan-regional distribution centers, but are nonetheless at the consumption-end of supply chains.

- Risk at production-end due to relocation. We see much more risk for locations at the production-end of supply chains. They are subject to trends in manufacturing, including the rise of robotics, re/near-shoring, changes in government inducements, and changes in trade relations and regulations. By contrast, consumption-end location requirements experience demand as distributors bring goods into major consumer markets, which change very gradually over time. New York was the most populous city in the U.S. in 1900. It still is today. Large population centers also have the highest incidence of higher and better use, reinforcing value at the consumption-end of supply chains.

ENDNOTES

2. eMarketer, public company statements

3. Estimates compiled from CSCMP report prepared by AT Kearney, IMS Worldwide, public company filings, and Prologis Research

4. eMarketer

FORWARD-LOOKING STATEMENTS

This material should not be construed as an offer to sell or the solicitation of an offer to buy any security. We are not soliciting any action based on this material. It is for the general information of customers of Prologis.

This report is based, in part, on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. No representation is given with respect to the accuracy or completeness of the information herein. Opinions expressed are our current opinions as of the date appearing on this report only. Prologis disclaims any and all liability relating to this report, including, without limitation, any express or implied representations or warranties for statements or errors contained in, or omissions from, this report.

Any estimates, projections or predictions given in this report are intended to be forward-looking statements. Although we believe that the expectations in such forward-looking statements are reasonable, we can give no assurance that any forward-looking statements will prove to be correct. Such estimates are subject to actual known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those projected. These forward-looking statements speak only as of the date of this report. We expressly disclaim any obligation or undertaking to update or revise any forward-looking statement contained herein to reflect any change in our expectations or any change in circumstances upon which such statement is based.

No part of this material may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without the prior written consent of Prologis.

PROLOGIS RESEARCH

Prologis’ research department studies fundamental and investment trends and Prologis’ customers’ needs to assist in identifying opportunities and avoiding risk across four continents. The team contributes to investment decisions and long-term strategic initiatives, in addition to publishing white papers and other research reports. Prologis publishes research on the market dynamics impacting Prologis’ customers’ businesses, including global supply chain issues and developments in the logistics and real estate industries. Prologis’ dedicated research team works collaboratively with all company departments to help guide Prologis’ market entry, expansion, acquisition and development strategies.

ABOUT PROLOGIS

Prologis, Inc. is the global leader in logistics real estate with a focus on high-barrier, high-growth markets. As of March 31, 2018, the company owned or had investments in, on a wholly owned basis or through co-investment ventures, properties and development projects expected to total approximately 683 million square feet (63 million square meters) in 19 countries. Prologis leases modern distribution facilities to a diverse base of approximately 5,000 customers across two major categories: business-to-business and retail/online fulfillment.