Overview

In our interconnected world, significant disruptions underscore the need for resilient supply chains. The risks posed by COVID-19 to economic growth would likewise affect real estate in the near term; on both counts the magnitude is yet unknown. Still, structural trends point to resiliency for logistics real estate through this period and beyond, shaping both the fundamental and investment landscape. COVID-19 has become a catalyst for many to find workarounds that could become permanent, leading to lower demand in certain property sectors (e.g., telecommuting/office, e-commerce/retail). This volatility could translate to higher demand for logistics real estate (inventories, e-commerce, industry 4.0). As these trends become broadly realized, capital markets are likely to react quickly and, in turn, reflect this differentiation in valuation and investment performance.

Customers

Expect volatility. In the short term, demand may soften, freeing up space. However, this opportunity could be short-lived as some customers race to gain lost ground and expand their needs for facilities in support of business continuity and higher service levels.

Investors

Anticipate resiliency. While financial market volatility and headwinds to economic activity are near-term risks, interest rates have experienced a compensating decline. Customers and capital markets are likely to see a boost to logistics real estate demand resulting from inventory levels and e-commerce, even as other property types face demand headwinds. Consequently, sentiment towards the sector should remain positive, though near-term denominator effects could impact investment decisions.

COVID-19: The most serious risk so far to a lengthy global expansion. With so much uncertainty, estimates of the magnitude and duration of the negative impact span a wide range. On the demand side, economic activity has been suppressed in regions with high rates of infection; when that risk subsides, economic activity should rebound. In the interim, perceived credit risk could increase challenges for certain segments including travel/tourism and brick-and-mortar retailers. On the supply side, disruption in the production and movement of goods (and people) around the world tests complex supply chains. The drop in goods movement is occurring quickly, driven by China’s delayed return from Lunar New Year, and should be met with a compensating spike as suppliers work to catch up. Logistics real estate users are planning for both the shortage of activity and a subsequent replenishment surge. Historically, this kind of volatility has correlated with stronger demand for logistics real estate. Two examples—Brexit and the U.S.-China tariff implementation were followed by historically strong levels of net absorption in the UK and U.S.1

Short-term risks to real estate fundamentals have increased. The source of demand for most logistics real estate users has not changed: many items that flow through supply chains are tied to basic daily needs such as food and beverage, consumer products and medical supplies. Still, confidence around additional investments in logistics facilities may pause in this atmosphere of uncertainty.

For logistics real estate, several trends could soften this impact, including the following: structural demand drivers built on higher service level expectations; higher barriers to new supply and a disciplined development community; and sustained strong market conditions that have led to favorable lease terms (i.e., longer leases that buffer cash flows from short-term disruptions).

Heightened supply chain risks introduce new long-term supply chain trends that could boost demand. We see at least three specific areas of change, which together may translate to higher levels of demand after this current period of uncertainty:

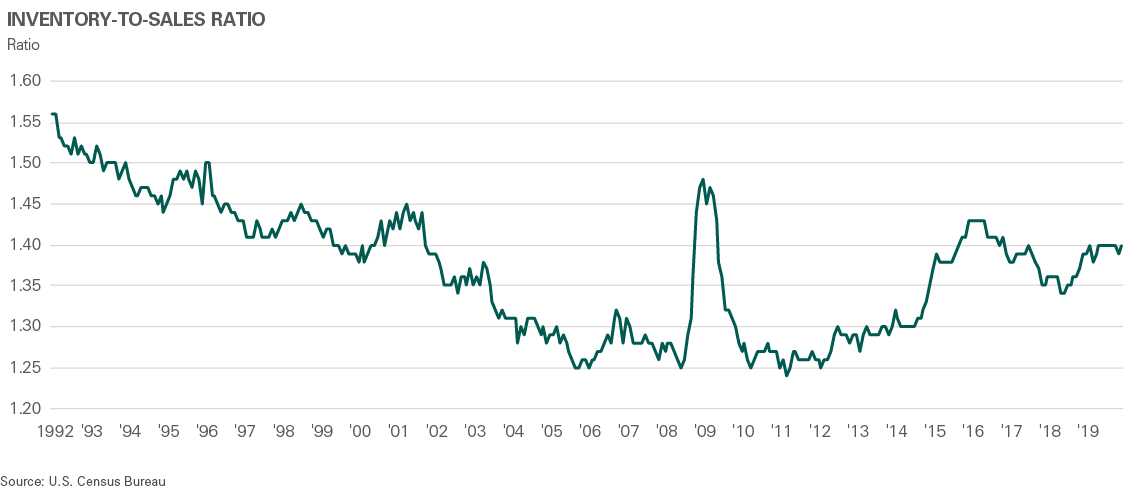

- Rising inventory levels. By design, supply chains minimize inventories to distribute goods at low cost. They don’t tolerate volatility, which leads to lost sales and revenues. In the past, events such as natural disasters and work stoppages at ports have led to step changes in inventory practices. In the wake of COVID-19, customers are likely to reassess ideal inventory volumes and business continuity plans—which could translate to greater demand.

- Continued e-commerce adoption. The current expansion has been characterized by the emergence of online shopping, which grew by 16.7% globally in 2019. COVID-19 doesn’t seem likely to change any of that; instead, it may increase the speed of adoption and the number of consumers who shop online. Given its value proposition, especially in the hardest-hit markets, e-commerce may rise in even greater importance in the basic functioning of everyday life.

- Diversifying manufacturing locations. COVID-19 may accelerate another structural trend: pushing manufacturing to new locations. Aided by industry 4.0 trends that boost productivity, manufacturers have been evolving their global supply chain strategies, increasingly emphasizing near-adjacent locations (e.g., Mexico, CEE) alongside reshoring. Strategies that focus on the consumption end of supply chains (see here for more background) will not be affected by these trends. While production-end locations alone are not a major investment strategy, this broadening of manufacturers creates second-order demand through both suppliers and networks that serve blossoming consumer markets.

Logistics is well-positioned to weather changes in real estate capital markets. While long-term leases counter volatility, capital flows may slow due to financial market volatility and the subsequent denominator effect. Yet tempering forces do exist. Investors have been under-allocated in real estate, especially logistics real estate. Interest rates have fallen and are likely to remain low. As it relates to fundamentals, logistics on the whole is better-positioned than other sectors given the potential boost to long-term demand from inventories and e-commerce. Capital is also likely to favor core assets in strong locations, demonstrating a flight-to-quality.

Endnotes

Forward-Looking Statements

This material should not be construed as an offer to sell or the solicitation of an offer to buy any security. We are not soliciting any action based on this material. It is for the general information of customers of Prologis.

This report is based, in part, on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. No representation is given with respect to the accuracy or completeness of the information herein. Opinions expressed are our current opinions as of the date appearing on this report only. Prologis disclaims any and all liability relating to this report, including, without limitation, any express or implied representations or warranties for statements or errors contained in, or omissions from, this report.

Any estimates, projections or predictions given in this report are intended to be forward-looking statements. Although we believe that the expectations in such forward-looking statements are reasonable, we can give no assurance that any forward-looking statements will prove to be correct. Such estimates are subject to actual known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those projected. These forward-looking statements speak only as of the date of this report. We expressly disclaim any obligation or undertaking to update or revise any forward looking statement contained herein to reflect any change in our expectations or any change in circumstances upon which such statement is based.

No part of this material may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without the prior written consent of Prologis.

About Prologis Research

Prologis’ Research department studies fundamental and investment trends and Prologis’ customers’ needs to assist in identifying opportunities and avoiding risk across four continents. The team contributes to investment decisions and long-term strategic initiatives, in addition to publishing white papers and other research reports. Prologis publishes research on the market dynamics impacting Prologis’ customers’ businesses, including global supply chain issues and developments in the logistics and real estate industries. Prologis’ dedicated research team works collaboratively with all company departments to help guide Prologis’ market entry, expansion, acquisition and development strategies.

About Prologis

Prologis, Inc., is the global leader in logistics real estate with a focus on high-barrier, high-growth markets. As of December 31, 2019, the company owned or had investments in, on a wholly owned basis or through co-investment ventures, properties and development projects expected to total approximately 964 million square feet (89 million square meters) in 19 countries.

Prologis leases modern logistics facilities to a diverse base of approximately 5,500 customers across two major categories: business-to-business and retail/online fulfillment.