With e-commerce setting records during the 2020 holiday season and package deliveries forecast to grow by 80%1 over the next decade, a new study by the MIT Real Estate Innovation Lab reveals the tangible environmental benefits of online shopping.

Driven by the stay-at-home economy, online retailing surged and remained at peak levels throughout 2020. Early estimates suggest U.S. online sales grew by upwards of 50%2 (y/y) in 2020’s expanded holiday shopping season, with similar trajectories in other major e-commerce markets including China, Europe, Japan and elsewhere. Using average emissions results from the MIT study, the share shift to e-commerce resulted in approximately 2.4% fewer emissions per package.

Takeaways

Fact:

Carbon emissions from online shopping are 36% lower, on average, than those produced by in-store trips3.

Impact:

E-commerce has a clear sustainability advantage over in-store shopping, even after factoring in higher returns and packaging.

Fact:

E-commerce in U.S. accounted for almost 20% of overall retail sales last holiday season, more than 6 percentage points higher than 20194.

Impact:

Peak e-commerce sales had a positive effect on carbon emissions.

Fact:

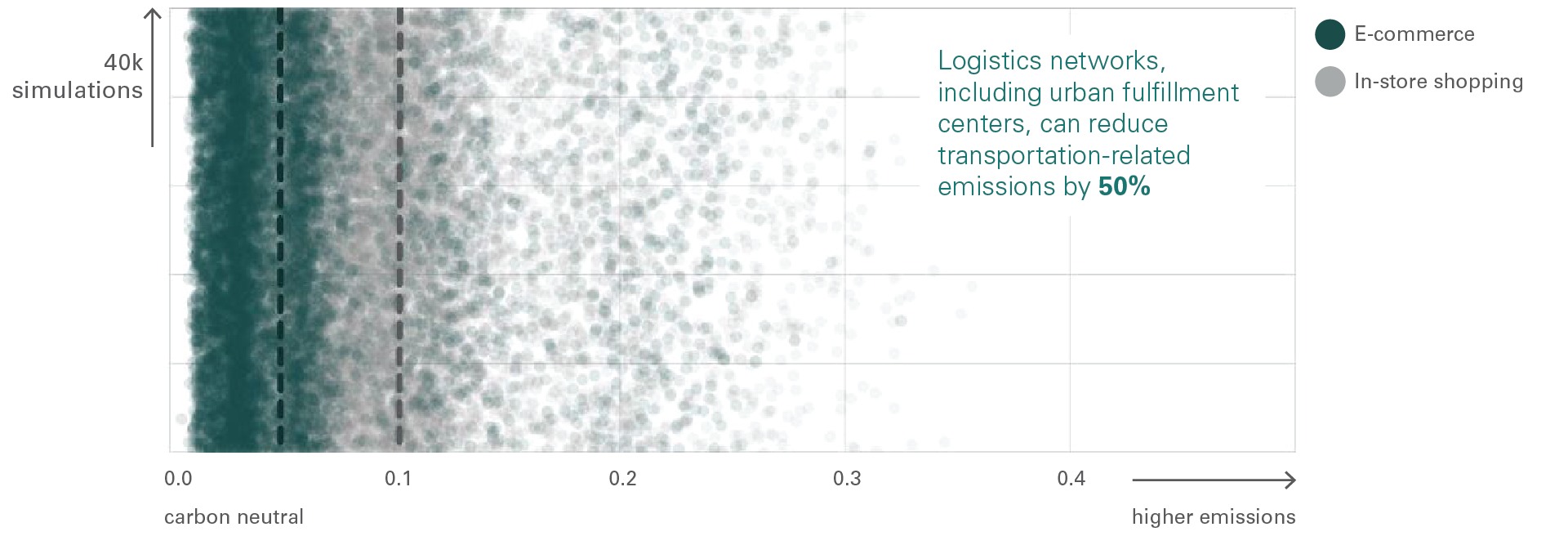

Built-out logistics networks, which include urban fulfillment centers, can reduce transportation-related emissions by 50%3.

Impact:

The carbon footprint per package can be reduced by about 10%3.

Fact:

For e-commerce, the positive carbon impact of efficient transportation routes is 2.5x the negative impact of excess packaging3. Fleet electrification increases this advantage further.

Impact:

A full standard van can replace more than 100 individual car trips3.

Deeper Dive

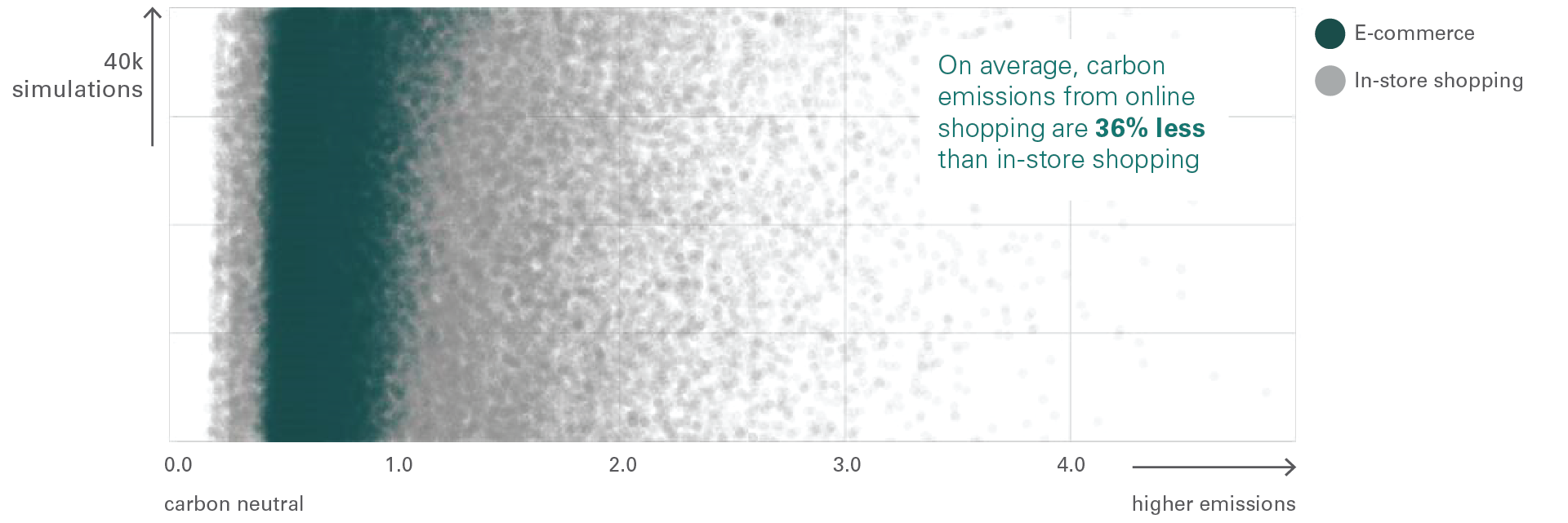

Carbon emissions from online shopping are on average 36% lower than those produced by in-store shopping3. E-commerce was the more sustainable option in more than 75% of the base case trials by MIT. For each scenario, the study used 40,000 trials of a Monte Carlo simulation that modeled a variety of consumer behaviors that, in aggregate, are important indicators of environmental impact: number of items purchased, distance to/from store and logistics facility, returns and type of transport. In addition to the base case, 11 other scenarios were studied which changed an aspect of consumer behavior or retailer operations.

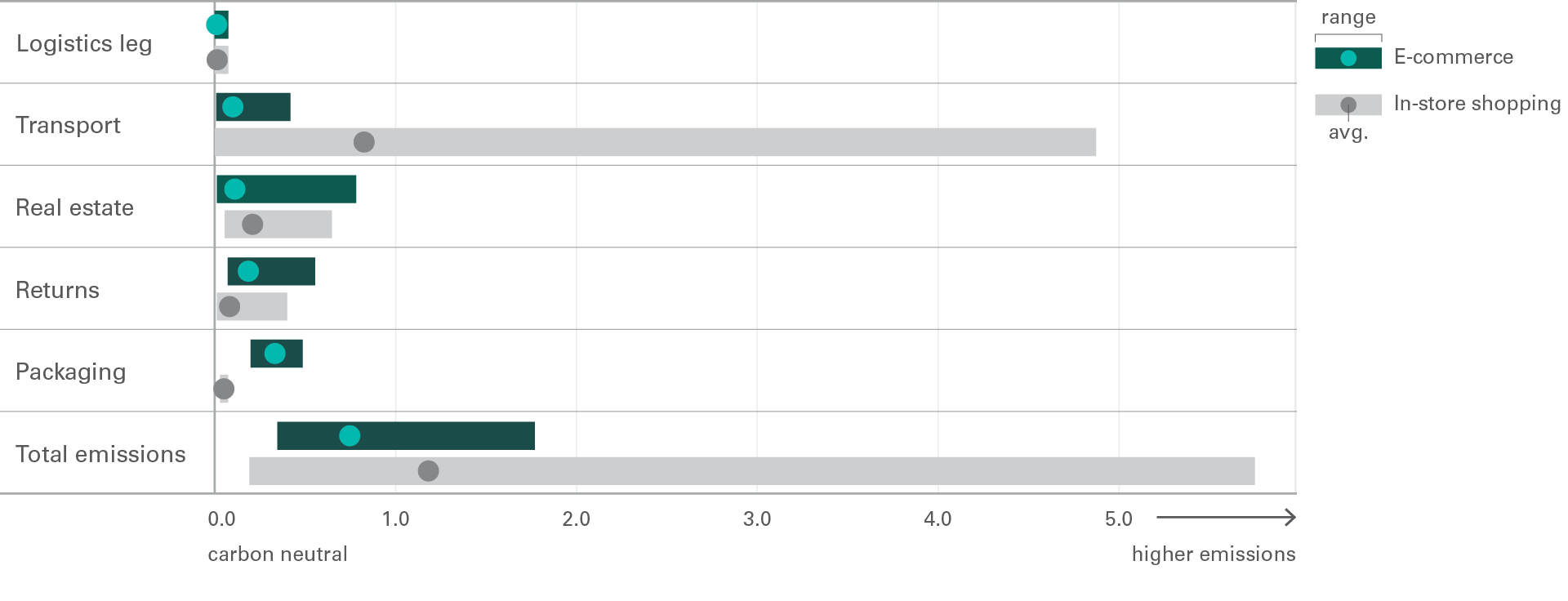

Exhibit 1

RANGES OF EMISSIONS BY SOURCE, E-COMMERCE AND BRICK-AND-MORTAR

kgCO2/item

Source: MIT, Prologis Research

Consolidating deliveries on a “circular route” reduces transportation-related emissions by almost 90%3. Transportation is the largest source of in-store shopping-related emissions and produces 2.5x the carbon emissions of e-commerce packaging, its largest carbon footprint contributor. In the case of direct-to-home delivery, a full standard van can replace more than 100 individual car trips3. In turn, order consolidation and network optimization reduce costs for e-commerce operators.

Exhibit 2

TOTAL EMISSIONS, E-COMMERCE VS. IN-STORE SHOPPING

kgCO2/item

Source: MIT, Prologis Research

Direct-to-home delivery from urban fulfilment centers can be a powerful lever to further decrease emissions. Built-out logistics networks which deliver goods from urban fulfilment centers close to consumers (rather than from facilities outside the urban core) can save some 50% of transport-related greenhouse gas emissions and reduce overall footprint per package by an average of 10%3. Placing goods as close as possible to the end consumer minimizes final delivery distances and congestion. This improves delivery times and reduces costs by maximizing delivery fleet load capacities.

Exhibit 3

TRANSPORT-ONLY EMISSIONS, LOGISTICS NETWORKS INCLUDING URBAN FULFILMENT CENTERS VS. E-COMMERCE, BASE CASE

kgCO2/item

Source: MIT, Prologis Research

Advancements in smart buildings, electrification of vehicles and artificial intelligence (AI) can foster even more sustainable operations. These emerging technologies have the potential to align the interests of consumers, retailers and real estate investors in a mutual quest to lower carbon footprints. MIT modeled three ways logistics real estate users are improving the sustainability of their operations:

- Delivery vehicle electrification: Using today’s energy sources, this technology can decrease average transportation-related emissions by 27%3 and has the added benefit of reduced traffic noise. New vehicle models set to launch this year have a range of 200 miles, which will enable the handling of 90% of last-mile delivery routes in the U.S.5 Regulation is further catalyzing adoption and needed infrastructure build-out. Fifteen states and Washington, D.C. have announced plans to electrify all heavy-duty trucks, vans and buses over the next 15 to 30 years. Europe, meanwhile, is leading the introduction of low-emission traffic zones that require electric delivery vans. Today, these low-emission traffic zones apply to two-thirds of the urban areas in which Prologis operates6. Forward-thinking retailers are adopting the technology. Amazon, for example, has ordered 100,000 electric vans and anticipates that the first 10,000 will be on the road next year7.

- Packaging: Packaging is the largest source of emissions for e-commerce (albeit a fraction of the carbon savings from efficient goods transport). Still, innovations in this area have the potential to make online shopping even more environmentally friendly. On average, emissions from packaging are approximately six times higher for online purchases compared to in-store purchases, primarily due to the use of cardboard materials and individual packaging3. MIT modeled a scenario in which the emissions of cardboard boxes were replaced by emissions of a paper bag in 80% of e-commerce purchases. In this scenario, e-commerce is more sustainable in 90% of all trials; today’s base case is 75%. Many retailers are adopting eco-friendly packaging materials, while others are automating packaging - analyzing and recommending the best size and type of packaging for any combination of items. Replacing boxes with bags and padded mailers decreases the volume and weight and of packages, which can contribute to lower emissions.

- Data: Advanced analytics and IoT-based solutions such as load-pooling and dynamic rerouting could reduce emissions by 10%, unit costs by 30% and congestion by 30%8. This data can support fewer returns, as well. For instance, AI-based solutions can produce size and style recommendations to online shoppers based on previous purchases, minimizing returns. MIT modeled a scenario in which the online purchase return rate decreased by 50%, leading to a lower e-commerce carbon footprint in 80% of trials.

Methodology & Approach

The MIT study referenced models the carbon footprint of consumer shopping behavior by assembling the pertinent variables and then simulating scenarios where this range of parameters is modified. For this study, a Monte Carlo simulation executed 40,000 trials (10,000 across 4 regions) per 12 scenarios and produced measurable results that were then plotted for interpretation, given the range of consumer behaviors that can change total carbon emissions.

This report cites findings from an independent study conducted by the MIT Real Estate Innovation Lab. Prologis is a long-term partner of MIT’s Center for Real Estate and its Real Estate Innovation Lab, and this research was made possible in part through Prologis’ support.

Footnotes

1 World Economic Forum (pre-pandemic forecast)

2 Mastercard SpendingPulse (holiday period from Oct. 11 to Dec. 24)

3 MIT

4 Mastercard SpendingPulse (holiday period from Oct. 11 to Dec. 24)

5 Chanje’s and Mercedes

6 European Commission and Urban Access Regulations

7 https://www.aboutamazon.com/news/transportation/introducing-amazons-first-custom-electric-delivery-vehicle

8 World Economic Forum

Forward-Looking Statements

This material should not be construed as an offer to sell or the solicitation of an offer to buy any security. We are not soliciting any action based on this material. It is for the general information of customers of Prologis.

This report is based, in part, on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. No representation is given with respect to the accuracy or completeness of the information herein. Opinions expressed are our current opinions as of the date appearing on this report only. Prologis disclaims any and all liability relating to this report, including, without limitation, any express or implied representations or warranties for statements or errors contained in, or omissions from, this report.

Any estimates, projections or predictions given in this report are intended to be forward-looking statements. Although we believe that the expectations in such forward-looking statements are reasonable, we can give no assurance that any forward-looking statements will prove to be correct. Such estimates are subject to actual known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those projected. These forwardlooking statements speak only as of the date of this report. We expressly disclaim any obligation or undertaking to update or revise any forward-looking statement contained herein to reflect any change in our expectations or any change in circumstances upon which such statement is based.

No part of this material may be (i) copied, photocopied or duplicated in any form by any means or (ii) redistributed without the prior written consent of Prologis.

About Prologis Research

Prologis’ Research department studies fundamental and investment trends and Prologis’ customers’ needs to assist in identifying opportunities and avoiding risk across four continents. The team contributes to investment decisions and long-term strategic initiatives, in addition to publishing white papers and other research reports. Prologis publishes research on the market dynamics impacting Prologis’ customers’ businesses, including global supply chain issues and developments in the logistics and real estate industries. Prologis’ dedicated research team works collaboratively with all company departments to help guide Prologis’ market entry, expansion, acquisition and development strategies.

About Prologis

Prologis, Inc. is the global leader in logistics real estate with a focus on high-barrier, high-growth markets. As of September 30, 2020, the company owned or had investments in, on a wholly owned basis or through co-investment ventures, properties and development projects expected to total approximately 976 million square feet (91 million square meters) in 19 countries.

Prologis leases modern distribution facilities to a diverse base of approximately 5,500 customers across two major categories: business-to-business and retail/online fulfillment.