|

Highest growth, U.S./Canada |

Highest growth, Europe |

| 1. Baltimore-Washington D.C. | 1. Greater London |

| 2. Central Valley | 2. Hamburg |

| 3. Toronto | 3. Frankfurt-Rhein Neckar |

| 4. Reno | 4. Hannover |

| 5. Nashville | 5. Munich |

Introduced in 2015, the Prologis Logistics Rent Index examines trends in net effective market rental growth2 in key logistics real estate markets in North America, Europe, Asia and Latin America3. Our proprietary methodology focuses on taking rents, net of concessions, for logistics facilities. To create the index, Prologis Research combines the company’s local insights on market pricing dynamics with data from our global portfolio. Rental rates at the regional and global levels are weighted averages based on estimates of market revenue.

What's new?

- Despite a mid-year dip due to the pandemic, global rent growth improved through year-end 2020 and ended with a 2.9% full-year increase.

- In North America, outperformance in demand resulted in healthy rent growth.

- In Europe, recovery materialized as the market likewise benefited from growing secular trends and limited supply.

Why does it matter?

- Demand surpassing expectations highlighted the broadening of structural demand drivers. These include an acceleration in e-commerce, reassessment of inventory levels, and the requirement for speed to market. As the result, historic vacancies remained low in many markets.

- Willingness to spend on expanding logistics networks has increased as users view e-commerce distribution and speed to market as competitive advantages for revenue generation. At the same time, the incremental cost of logistics real estate remains a small portion of total supply chain costs, with rents representing approximately 5%.

- Replacement cost economics support future growth, as land prices continued to rise across a broad range of markets.

What's next?

- Prologis Research anticipates a continuation of growth trajectory across the company’s markets globally.

- Structural demand trends and rising barriers to supply—such as longer entitlement and permitting processes and increasing replacement costs—point to continued resilience despite lingering economic uncertainty.

- Expansion is expected to be the most pronounced in infill locations where expanding e-fulfillment should result in logistics users competing for the best locations.

- Outperformance of regional distribution markets, which benefited from big box demand in 2020, may normalize in 2021 and beyond as new supply begins to be delivered in low-barrier submarkets.

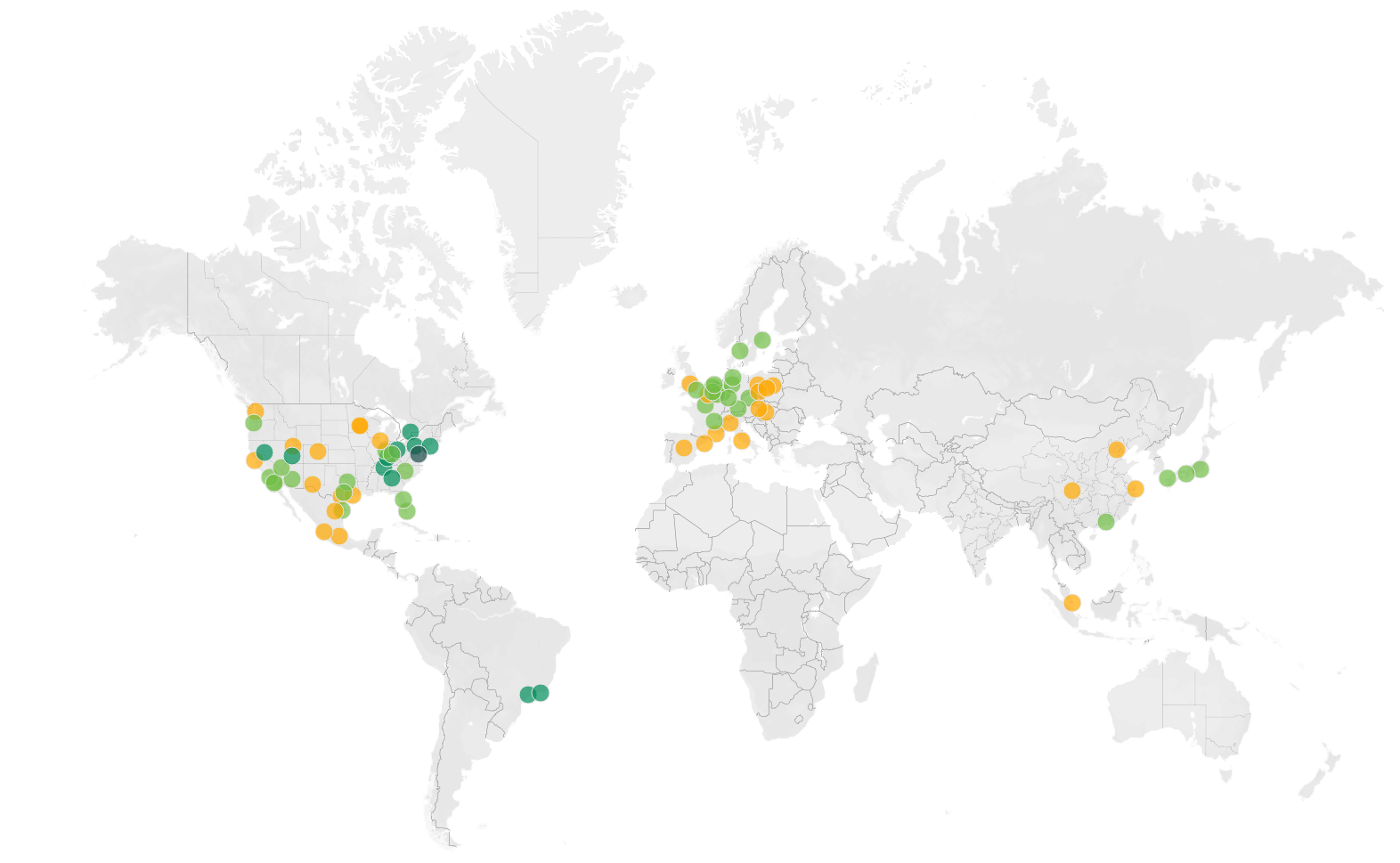

Exhibit 1: 2020 RENT GROWTH BY MARKET, TOP 75 LOGISTICS CLUSTERS

GLOBAL OVERVIEW

Key findings from the 2020 Rent Index:

- Pandemic uncertainty led to negative growth in most global markets during the second quarter of 2020. The exceptions were Japan and Brazil, which recorded stable or positive growth throughout the year.

- North America and Brazil led 2020 growth. Structural demand bolstered positive pricing power rapidly in these markets as replacement costs continued to move upward.

- Dips were the most severe in supply-rich markets. These markets, which are relatively few, include Houston, Poland and West China.

- Most markets experienced quick recovery. Concessions initially given to secure occupancy were reversed quickly as vacancies remained low and demand stayed healthy.

- Growth in 2020 occurred in the back half of the year. The strength of logistics fundamentals was tested and proven in 2020 and underscored structural trends that the pandemic accelerated.

2020 top performers, global

- Baltimore-Washington D.C.

- Central Valley

- Toronto

- Reno

- Nashville

- New Jersey-New York City

- Pennsylvania

- Rio de Janeiro

- Atlanta

- Columbus

- Structural trends are expected to drive demand for prime logistics real estate. The future of supply chains is larger, faster, more resilient and closer to end consumers. Modern space is also needed to incorporate technological advancements that improve efficiency and solve customer pain points.

- The acceleration of e-commerce adoption will add to the need for more space close to end consumers. Urban fulfillment speeds up delivery times, optimizes costs and reduces total miles traveled. Customers focused on sustainable operations may also find reduced carbon emissions from a built-out logistics network including urban fulfillment centers.

- Disruptions from the pandemic are poised to continue. Lockdowns and other COVID-19-related situations may constrain customers’ operations, though the volatility is expected to be less severe than in 2020 as many customers now have better supply chain visibility.

- Rising inventory levels should add to demand growth. As retailers restock and build in buffer to accommodate surges in consumer demand, requirements should increase.

- Economic recovery is expected to add cyclical demand to the second half of 2021. Pending the success of inoculation programs across the globe, the reopening of economies is expected to lead to an economic uptick generating cyclical demand.

- Replacement costs and supply barriers are likely to intensify. The influx of equity focused on logistics has increased, driving up competition for assets and development.

What does it mean for customers?

Space availability increased marginally in 2020, primarily in supply hotspots. Securing space in land-constrained locations requires advanced planning. Increasing operational efficiency and warehouse utilization through supply chain reconfiguration can also foster expansion in the absence of excess supply.

What does it mean for investors?

The acceleration of structural trends such as e-commerce and inventory building adds layers of demand, namely in locations near end consumers. Demand was broad-based and healthy in 2020, but, going forward, the inability to respond with supply will lead to more uniform outperformance for land-constrained locations.

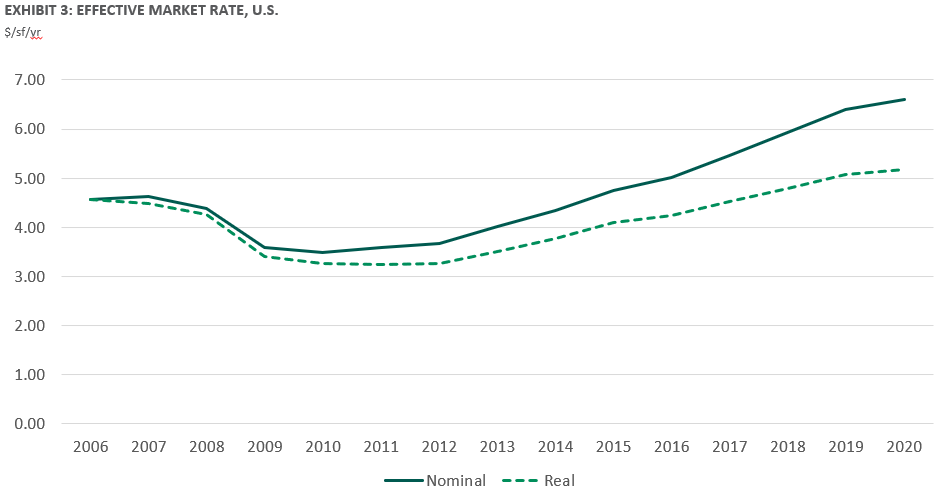

United States/Canada:

- At 3.2% in 2020, the pace of rent growth decelerated from 8% in 2019 due to new supply (as expected) and COVID-19 (unexpected).

- However, logistics real estate demand remained positive, prompting rental rate appreciation through most of the year. Even as more than 300 million square feet of new space were brought to the market, structural shifts and a customer base with an overweight exposure to essential industries accommodated this growth.

- Rent growth momentum shifted toward larger and newer product upstream of the supply chain. In the East Region, Toronto and New Jersey/New York City were among the top-ten markets, the result of strong trade and local consumption drivers and high barriers to supply, which fueled strong rent growth. Other 2020 rent growth leaders included key gateway markets such as the Inland Empire, Pennsylvania, Dallas and Atlanta. Several multi-market distribution hubs also recorded growth above 5% as vacancy rates remained low; those locales included Baltimore, Central Valley, Reno, Nashville and Louisville.

- Replacement cost growth and rising barriers to supply point to continued pricing power. Intensifying competition for limited developable parcels is driving up land costs in many U.S. markets. At the same time, increasing regulatory barriers and community resistance is limiting development, adding costs and extending timelines. These trends should amplify the supply-demand imbalance, especially in infill areas. While many infill markets outside the East region saw flat to moderately negative rent growth in 2020 (after leading North America for several years prior), the combination of limited supply and a return to demand as Last Touch® distribution capabilities are built out points to accelerating rent growth ahead.

Exhibit 3: U.S./Canada rental rates

Source: Prologis Research, Consensus Economics

U.S./Canada top performers

- Baltimore-Washington DC

- Central Valley

- Toronto

- Reno

- Nashville

- New Jersey-New York City

- Pennsylvania

- Atlanta

- Columbus

- Louisville

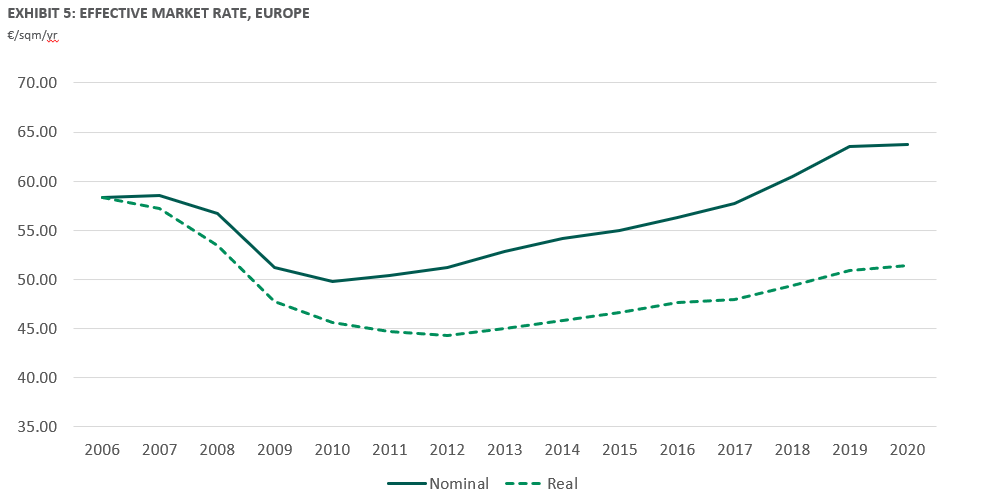

Europe:

- Rent growth remained positive in 2020. Net effective rents were flat at 0.3% (y/y) for Europe as a whole. Stability was driven by headline rents while concessions, such as free rent, showed a temporary increase before returning to low levels across most European markets by year-end. Despite all the Brexit turmoil, UK rental rates remained stable on the whole, driven by robust demand and limited new deliveries.

- Secular demand drivers and low vacancy rates underpinned market performance. Demand was fueled by industries that provide essential goods, including e-commerce. New supply paused in the first weeks of the pandemic and was disciplined through year-end. Vacancy increased (y/y) but remained low at 4.2% in Europe—among the lowest globally. Rising replacement costs, structurally driven by land constraints, continued through 2020, providing continued momentum in rent growth.

- Supply barriers shaped rental growth rates. Land constraints that produced sustained low vacancy were the common denominator of those markets that showed the strongest rent growth. Markets such as Rhine Ruhr, Southern Netherlands, Prague and the urban infill markets of London and Paris recorded the highest rental growth rates. In these markets, demand is deep and diverse. On the other side of spectrum, markets with persistently high vacancy rates and active speculative pipelines recorded the slowest rent growth. There are only a handful of these markets in Europe, with a concentration in Poland.

Exhibit 5: Europe rental rates

Source: Prologis Research, Consensus Economics

Europe top performers

Highest growth, Europe

- Greater London

- Hamburg

- Frankfurt-Rhein Neckar

- Hannover

- Munich

- Rhine-Ruhr

- Rotterdam

- Prague

- Brussels-Antwerp

- Stockholm

*Greater London consists of London and South East England

Latin America:

Mexico: Market rents posted a modest net decrease in 2020, in tandem with the global arc of a sharp correction in the second quarter followed by steady improvement. Fueled by e-commerce and export growth, demand for modern logistics space was robust throughout Mexico, leading to sustained low vacancy despite economic headwinds. New development starts fell, improving forward-looking prospects for continued rental growth. Mexico City and Tijuana should lead among Mexican markets, based on strong demand and barriers to new supply.

Brazil: Pandemic-related economic turbulence did not dissuade major customers from expanding in Brazil’s main markets, particularly those serving e-commerce. In 2020, market rental growth increased by 5.9% due to structural demand, rising replacement costs and low vacancy for high-quality modern product. Another year of rate cuts and strong investor demand for logistics assets produced sizeable cap rate compression.

Asia:

Japan: Market rents held steady on low market vacancies. Despite economic weakness due to COVID-19, structural factors continued to generate significant leasing demand throughout 2020, even beating pre-pandemic expectations for the year. Strong uptake from retailers building out networks for e-commerce, pharmaceuticals and 3PLs led to vacancies in Tokyo and Osaka of less than 1%. Under such scarcity of vacant space, market rents rose slightly across all markets in Japan. This momentum will likely persist throughout 2021, as pre-leasing activity has already been very high in Tokyo, reflecting a continuing need to meet higher logistics requirements.

China: Market rents fell overall but with wide market-level differences. As a historically high-growth market, China is estimated to have delivered over 90 MSF of completions in 2020, an increase of around one-third y/y. The shock from COVID-19 stalled leasing activity in the year. As a result, overall market vacancy is estimated to have risen to around 20% as of the end of 2020. With higher availability in a range of markets, rental rates fell 4% overall. The decline was most severe in markets that faced high supply even before the pandemic, namely in West China, parts of North China such as Shenyang and Tianjin, and Wuhan. These markets suffered double-digit declines, bringing market rents well below replacement cost rents. However, core markets in and around the Tier 1 cities of Shanghai, Beijing and Guangzhou held steady, ending the year with 2% higher market rents—though still a slightly moderated pace based on historical averages.

2021: THE PROLOGIS RESEARCH OUTLOOK

After a year of volatility, 2021 is expected to be a steady year of growth for most markets. We note risks to the outlook, among them the ongoing pandemic and political and economic headwinds. The resilience of the logistics real estate sector has attracted significant equity; in this atmosphere, we are monitoring how this wall of capital now targeting the sector could lead to areas of oversupply. Substantial structural demand tailwinds remain, replacement costs continue to rise and new supply is unlikely to meet this demand in most markets, in turn setting the tone for a year of strong rent growth.

2 Throughout this report, Prologis Research tracks rental rates on a net effective basis. Net effective rents are principally net of free rent. By doing so, we can capture changes in the true economic terms of the offer

3 The Prologis Rent Index was introduced in 2015 as a way to quantify and analyze rental growth trends across the global logistics real estate sector